Top Hedge Funds in Switzerland

Switzerland is a leading hub for hedge funds, attracting investors from around the world. The country's long-standing tradition of political neutrality, along with its stable economy and favourable regulatory environment, make it an attractive destination for hedge funds.

The top hedge funds in Switzerland manage billions in assets and have a reputation for delivering strong returns. These funds are based in Zurich, Zug, Geneva, and Lugano, with many having offices in other parts of the ,world.

Which Swiss Hedge Funds are worth keeping an eye on?

Here are some of the top hedge funds in Switzerland, in order of date of founding:

Diamond Capital Management

Diamond Capital Management used to be called Nutrimenta Finance & Investments Ltd, which was founded in 1972. It is described as a independent asset management boutique. Although based in Geneva, it provides financial services to high net worth families around the world.

Tramondo Investment Partners

The group of which Tramondo Investment Partners is part, was founded in Zug, Switzerland, in 1978, and now also has an office in Zurich. In 2021, it had an AUM of CHF 2.8 billion.

Partners Group

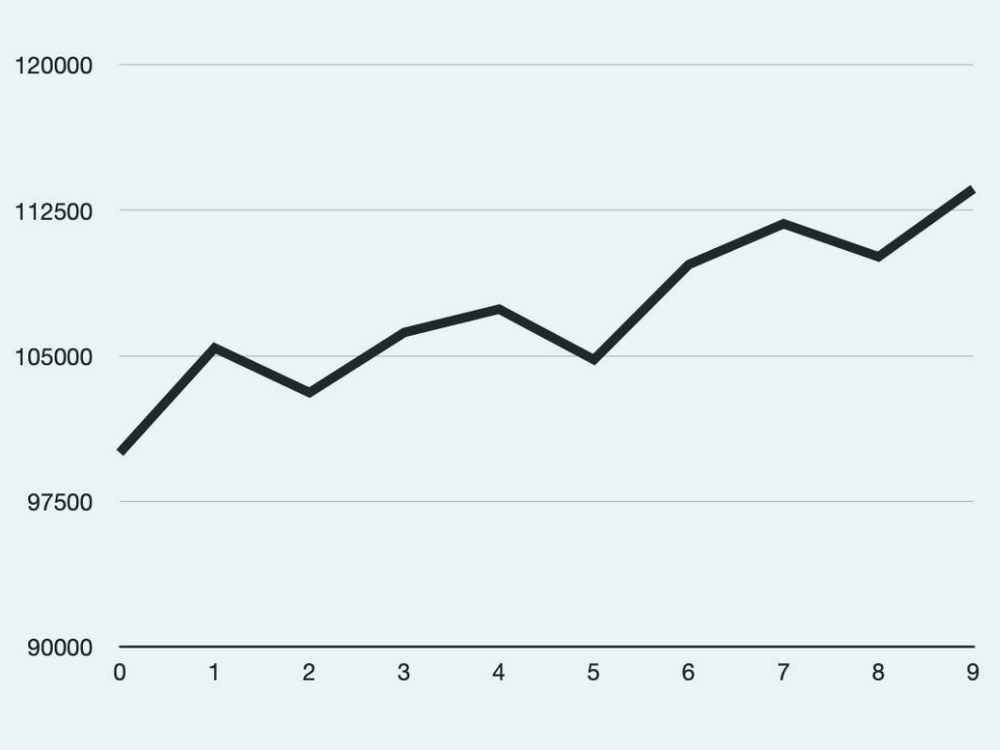

Partners Group was founded in 1996 by Marcel Erni, Alfred Gantner and Urs Wietlisbach. In 2022, it had AUM of CHF 119 billion. Although it was founded in Switzerland, Partners Group now has offices in ,Europe, Asia, and the US, with over 1,800 employees. Its AUM currently stands at CHF 125 billion (at time of writing in August 2023).

Corum Vermögensverwaltung

Corum Vermögensverwaltung is based in Zurich and was established in 2002 by Stefan Bucher, who perviously worked in the private banking and trading departments of a German private bank in Zurich.

Brainvest Wealth Management

Brainvest Wealth Management is a Geneva-based wealth management firm established in 2003. Headquartered in Geneva, this firm has offices in Miami, São Paulo and Rio de Janeiro.

Copernicus Wealth Management

Founded in 2016 and headquartered in Lugano with a new office in Zurich, Copernicus Wealth Management is an independent asset management firm which offers a range of investment services to high-net-worth (HNW) individuals and institutional clients.

Regulation of Swiss Hedge Funds

FINMA (the Swiss Financial Market Supervisory Authority) is the authority responsible for regulating hedge funds in Switzerland, and all hedge funds in Switzerland are required to register with FINMA. It is an independent regulatory body that ensures that all hedge funds comply with the Swiss Collective Investment Schemes Ordinance (CISO) and the Swiss Collective Investment Schemes Act (CISA).

FINMA monitors hedge fund regulatory compliance by conducting on-site inspections, and taking enforcement action if necessary. FINMA also requires that all hedge funds disclose to investors their investment strategies, fees and investment risks.

The future of Hedge Funds in Switzerland

There has been a significant increase in the number of mergers and acquisitions within the hedge fund industry in Switzerland over the last few years. Nevertheless, Switzerland is very likely to continue to be a popular country for hedge fund investment into the future, due to its international reputation and stability.